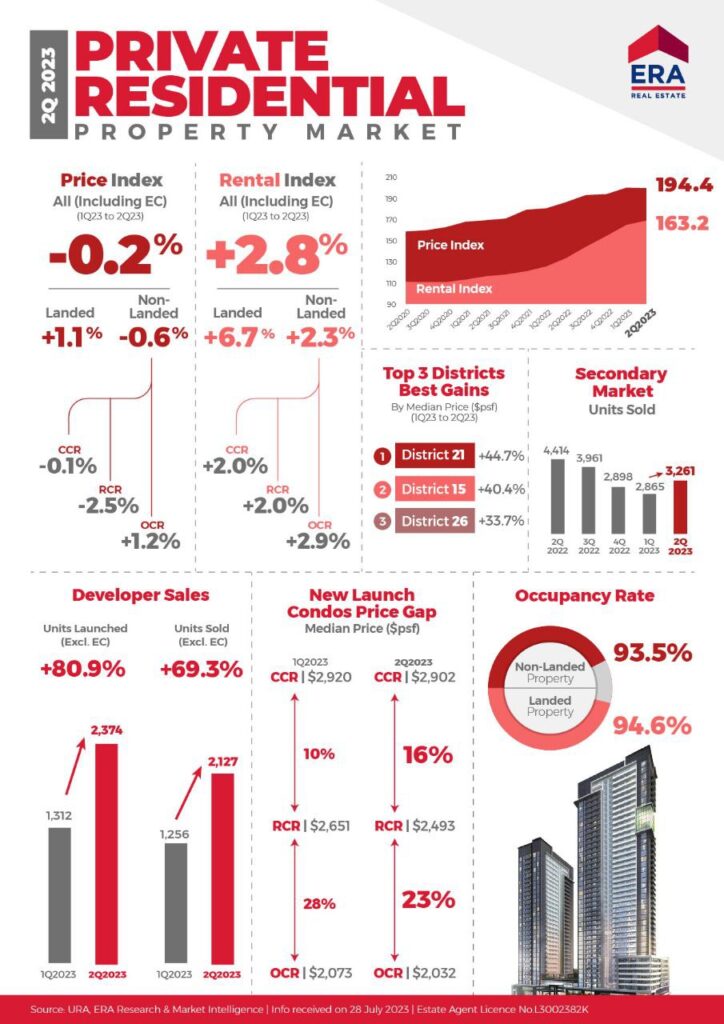

2Q 2023 – Private Residential Property Market

In 2Q2023, the private residential price index fell by 0.2% qoq after a 3.3% rise in the previous quarter. Conversely, the rental index displayed a growth of 2.8% qoq, albeit a more moderate one after a 7.2% increase in the previous quarter. Large-scale new condominium launches such as Tembusu Grand (638 units) and the Reserve Residences (732 units) saw high take-up rates; selling 53% and 71% of their units during the launch weekend.

The slight decline in the private residential price index can be strongly attributed to competitive pricing in the RCR new sales market despite several new launches in the region. These new launches were priced competitively in order to achieve the targeted sales rate at their initial launches.

The number of units sold in the secondary market increased by 12.5% from 2,865 units to 3,621 units for 2Q2023.

This marks the first time since 1Q2022 that there has been a qoq increase in activity in the private secondary market following 4 consecutive quarters of declining transactions.

Looking forward, the private residential market will continue to be the preferred choice for HDB upgraders and we can expect to see a growing proportion of Singaporean buyers given the doubling of ABSD for foreigners since the April 2023 cooling measures.